DeSantis warns that CBDCs could become a powerful tool for government overreach, giving authorities the ability to track, control, and even restrict how people spend their money, posing a direct threat to financial privacy and personal freedom. [Image Source: Shutterstock]

DeSantis warns that CBDCs could become a powerful tool for government overreach, giving authorities the ability to track, control, and even restrict how people spend their money, posing a direct threat to financial privacy and personal freedom. [Image Source: Shutterstock]Florida Governor Ron DeSantis has taken a firm stand against Central Bank Digital Currencies (CBDCs), vowing to ban them if he wins the presidency. His position underscores growing concerns among some politicians and citizens about the risks associated with state-backed digital money.

DeSantis argues that CBDCs could grant governments excessive control over financial transactions, potentially undermining privacy and personal freedoms. He warns that such currencies might enable authorities to monitor and restrict how people spend their money, a scenario that raises alarms among privacy advocates and free-market supporters. By opposing CBDCs, DeSantis is positioning himself as a champion of individual rights and economic independence, drawing a stark contrast with policymakers who support their implementation.

His stance has ignited a national debate. Supporters of CBDCs see them as a necessary evolution of the financial system, offering benefits such as faster transactions, lower costs, and greater financial inclusion. They argue that digital currencies could enhance efficiency and security in payments, both domestically and across borders. However, critics like DeSantis caution that these advantages come at the cost of increased government oversight and the potential erosion of financial autonomy.

Advocates of DeSantis’s position fear that CBDCs could lead to excessive surveillance, allowing governments to track and possibly even control personal spending. They worry that such systems could be used to enforce financial restrictions, freezing assets or limiting transactions based on government policies. Opponents of this view counter that proper safeguards and regulations could prevent misuse, ensuring that CBDCs function as tools for innovation rather than instruments of control.

The race for Central Bank Digital Currencies (CBDCs) is intensifying, with economic powerhouses like China and the European Union charging ahead in the development of their own state-backed digital money. [Image Source: Shutterstock]

The race for Central Bank Digital Currencies (CBDCs) is intensifying, with economic powerhouses like China and the European Union charging ahead in the development of their own state-backed digital money. [Image Source: Shutterstock]The global conversation around CBDCs is heating up, with countries like China and members of the European Union actively developing their own digital currencies. Meanwhile, U.S. policymakers remain divided on whether to pursue a similar path. The debate over CBDCs reflects broader tensions between technological advancement and concerns about government oversight, making DeSantis’s opposition a key talking point in the upcoming election.

His firm rejection of CBDCs appeals to voters who are skeptical of expanding government influence in financial affairs. Unlike many world leaders who see digital currencies as an inevitable step forward, DeSantis views them as a threat to economic liberty. This stance has bolstered his reputation as a vocal critic of centralized financial control and has further solidified his appeal among conservatives who prioritize privacy and limited government intervention.

Critics argue that banning CBDCs outright could hinder U.S. innovation and put the country at a disadvantage in the evolving global financial landscape. They warn that rejecting digital currencies entirely could stifle progress and limit economic opportunities. Still, DeSantis remains unwavering, emphasizing that protecting personal freedoms and ensuring economic privacy must take precedence over technological developments.

As discussions about digital currencies continue, DeSantis’s pledge to block CBDCs highlights a growing ideological divide. His position reflects broader concerns about balancing innovation with privacy, and the outcome of this debate could shape the future of the U.S. financial system for years to come.

The largest five-year federal budget in the UAE's history

UAE strengthens role as global hub for cross-border e-commerce growthv

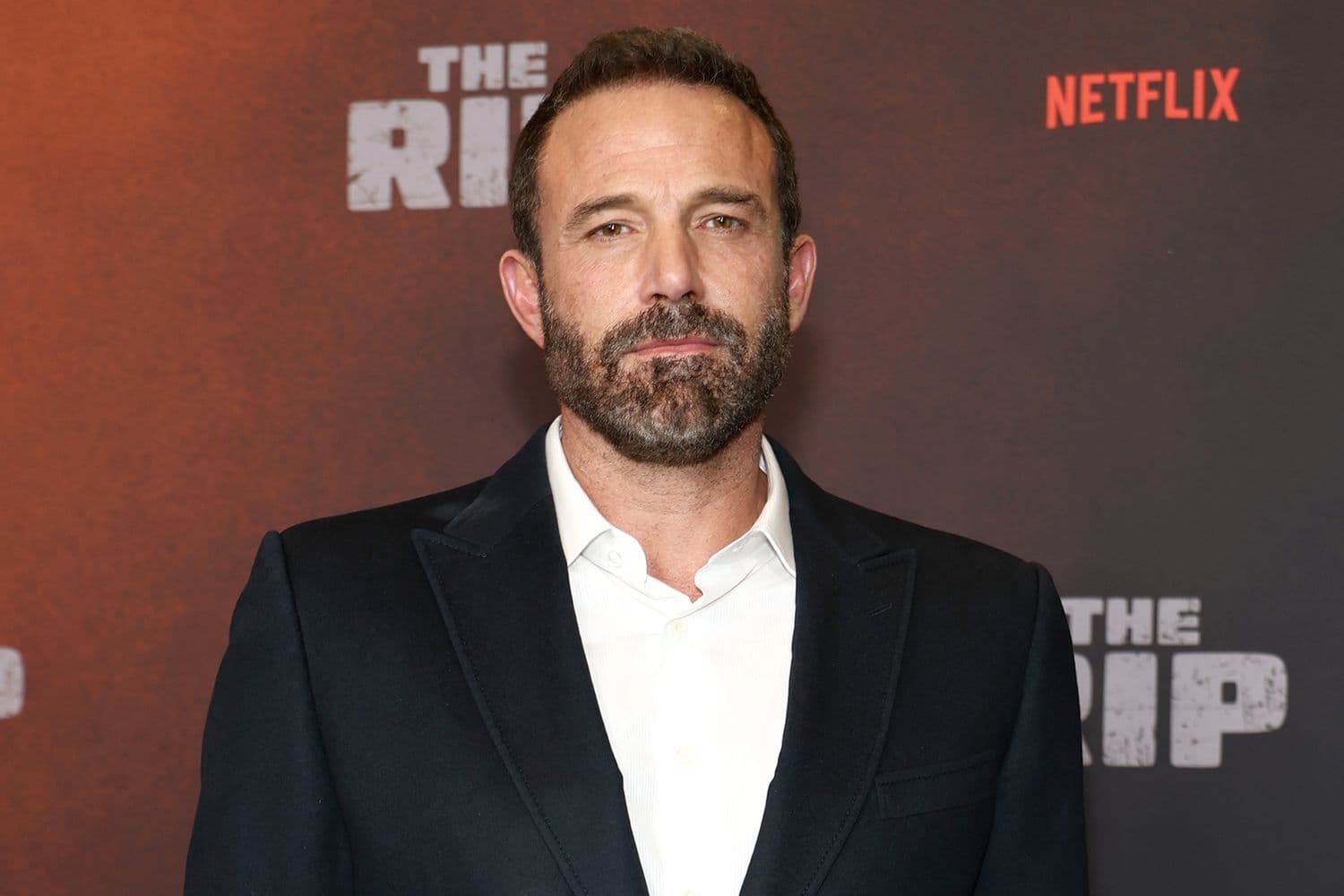

Netflix acquires Ben Affleck's AI firm InterPositive for undisclosed amount.

Staring price at USD 599.